Stock market outlook: The stock market recorded a gain of about one percent between GST reform and positive global signals in the week ended August 22. Both major index-Nifty and Sensex showed strength. However, on Friday, profit booking and technical correction limited the weekly gains.

Experts say that the market may show a positive attitude in the hope of Friday’s fast on Friday’s fast and possible interest rate deduction next month. On August 27, the market will be closed on the occasion of Ganesh Chaturthi, which will make this business week shorter.

Siddharth Khemka, head research of Motilal Oswal Financial Services, said that globally, American fee against India and GDP data market will affect the India-US GDP data market sentiment. They estimate that Indian equities will be supported by positive signs of GST 2.0 improvement and domestic economic strength.

At the same time, Vinod Nair, Head of Research of Geojit Investments, says that domestic economic indicators are giving hope to investors. He reported that the record-high composite PMI and initial signals in urban demand will support the market. The consumer sector is likely to benefit from favorable monsoon, low interest rate and GST improvement.

Additional tariff deadline close

The most important aspect would be whether there is any new information from the US about the additional 25 percent fee imposed on American goods due to India’s increased purchase of Russian oil, which is to be implemented from August 27. India is already paying 25 percent fee from August 1.

US authorities have canceled India’s scheduled journey during August 25-29, so there is no hope of extending the date of implementing an additional 25 percent fee or reducing the rate. At the same time, recently Foreign Minister Subrahmanyam Jaishankar said in the Economic Times World Leaders Forum 2025 that negotiations between India and the US are going on, but some farmers and small producers are required to protect the interests.

Ukraine-Russia Peace Agreement

The stock market investor Russia-Ukraine will monitor any signal on the peace agreement, as there is a lot of uncertainty about the possibility of Russia-Ukraine Agreement.

The peace talks between Russia and Ukraine are currently stuck. Russia took its biggest airstrike action after July. It targeted western Ukraine, which included the American factory in Ukraine. The Ukrainian army attacked an oil refinery in Rostov near Donbas region of Russia this week. According to Reuters report, Ukrainian President Volodimir Jailonsky said on Friday that Russia is making every effort not to meet and Putin, while Russia’s Foreign Minister said the agenda is not ready for such a meeting.

US President Donald Trump on Friday warned Russian President Vladimir Putin that ‘heavy sanctions’ would be imposed if Russia does not come on a peace agreement with Ukraine within two weeks. Trump held a conversation with Putin in Alaska to end the Russia-Ukraine war in Alaska earlier this week, after which preparations were made for a meeting between Putin and Jailonski, which could not be possible.

Stocks to watch: These 15 stocks will be in focus on Monday 25 August, you can get a chance to earn strong earnings

America’s GDP data

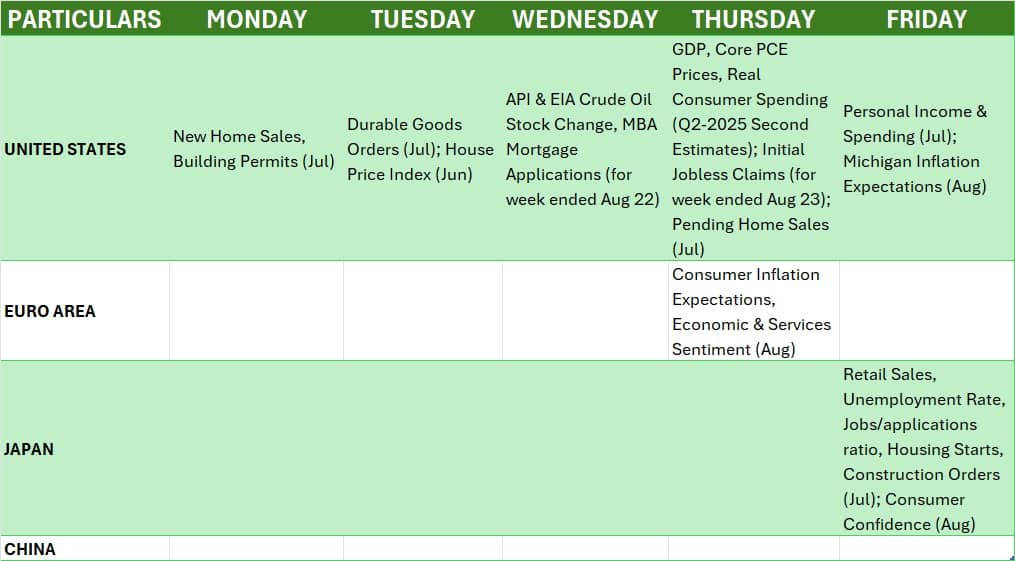

Apart from the tariff, different economic data coming from the US will be monitored next week. These include the second estimate of GDP development for the June quarter 2025, core PCE Price, and real consumer expenses, which will be released on August 28. Apart from this, monthly new home sales, durable goods orders, personal income and expenses, and weekly employment data are also important. Because all these will be important for the Fed’s interest rate decision in September.

According to the Advance Estimate, the US economy increased by 3 percent in the second quarter of the current calendar year, while the previous quarter had a decline of 0.5 percent.

Global Economic Data

In addition, consumer inflation expectations from the euro zone for the month of August and the emotional figures of the economic and service sector, as well as monthly retail sales for July from Japan, unemployment rate, housing start and construction orders will also be monitored.

GDP data of India

India’s GDP data for the June 2025 quarter will be released on August 29. According to the recent RBI forecast, the economy may register by 6.5 percent in the June quarter. At the same time, in the SBI Research Report, the growth of the quarter is described in the range of 6.8-7 percent. Financial deficit for July on the same day, foreign exchange reserves of the week ended on 22 August, and the fortnight’s bank loan and deposits will also be released on 15 August.

Industrial production data for July will also be declared on August 28 next week. Industrial production in June rose 1.5 percent, the lowest level of the last 10 months, while it was 1.9 percent as per the revised data in May.

Investors and traders will also keep an eye on FII activities. Although there was a purchase for a few days, he made a net sale of Rs 1,560 crore in the last week. However, this is much lower than the last several weeks. According to CEO Nikunj Saraf of Choice Wealth, FPIs cannot become a big buyer until the US yield declines and the tariff risk is not reduced. Also, the rupee is stable and the quarterly results of the companies are not better.

In contrast, the Domestic Institutional Investors (DII) gave strong support to the market and they continue to be buyers in equity. Their net purchase was Rs 66,184 crore, which is more than Rs 60,939 crore in the previous month. He made a net purchase of Rs 10,388 crore last week.

The rupee rose 0.21 percent for the first time in eight weeks to 87.3 against the USD. The US dollar index remained below 100 points from the second part of May, it fell 0.11 percent to 97.732 and remained in trend downwards for the third consecutive week.

Strengthening the path of strategic cell in IDBI Bank, LIC gets public shareholder status from Sebi

The primary market is going to be very busy next week. A total of 10 IPOs will be worth ₹ 1,240 crore, which will open for subscription. At the same time, eight new companies will be available for trading in the stock market. The IPO of Vikran Engineering and Anlon Healthcare in the mainboard segment will be ₹ 893 crore, which will open for public subscription on 26 August and will be closed on 29 August.

A total of eight IPOs will be launched in SME segment. Among them, the IPO of NIS Management and Globtier Infotech will open on 25 August. After this, the IPO of Sattva Engineering Construction and Current Infraprojects will be launched on 26 August. The first public issue of Oval Projects Engineering will open on August 28. At the same time, on August 29, three IPO-Sugs Lloyd, Abril Paper Tech and Snehaa Organics will open for subscription.

In public issues, Arc Insulation & Insulators, Classic Electrodes (India), Shivashrit Foods and Anondita Medicare, which were opened last week, will be closed next week. Meanwhile, a total of eight companies- Patel Retail, Vikram Solar, Gem Aromatics, Shreeji Shipping Global and Mangal Electrical Industries (from Mainboard Segment), and Studio LSD, LGT Business CONNEXTIONS WOR ARC Insulators (From sme segment) will be listed in the coming week.

Technical view

Technically Nifty 50 showed weakness on Friday and revealed in the same session close to the lower level of Monday. This led to a long barish candle on daily timeframe. At the same time, a shorter unearned candle with a long upper Vik on the weekly chart, which indicates pressure on the upper levels.

However, in the middle the index rescued the low-lying level (slightly above 24,850) in the intraday and remained above the 20 and 50-day EMA (24,830–24,840), which is positive. According to experts, if the index breaks these levels decisively in the coming sessions and is unable to take support at 24,700, beer can start filling the bullish gap of August 18. But if this level remains maintained, the index can again go up to 25,000, after which the next resistance at 25,150.

F&O segment condition

Monthly options data indicates that the Nifty 50 in F&O expiry week is likely to be in the range of 24,500-25,500. The maximum call open interest was on 25,000 strikes, followed by 25,100 and 25,500 strikes. The maximum call writing took place at 25,000 strikes, followed by 24,900 and 25,100 strikes. At the same time, the maximum put open interest was on 25,000 strikes, followed by 24,500 and 24,900 strikes. The maximum put writing took place at 24,900 strikes, followed by 24,400 and 24,600 strikes.

Meanwhile, India is showing favorable trends for Vix Bulls. It fell 5.08 percent to 11.72 levels and closed under short-term moving average.

Corporate action

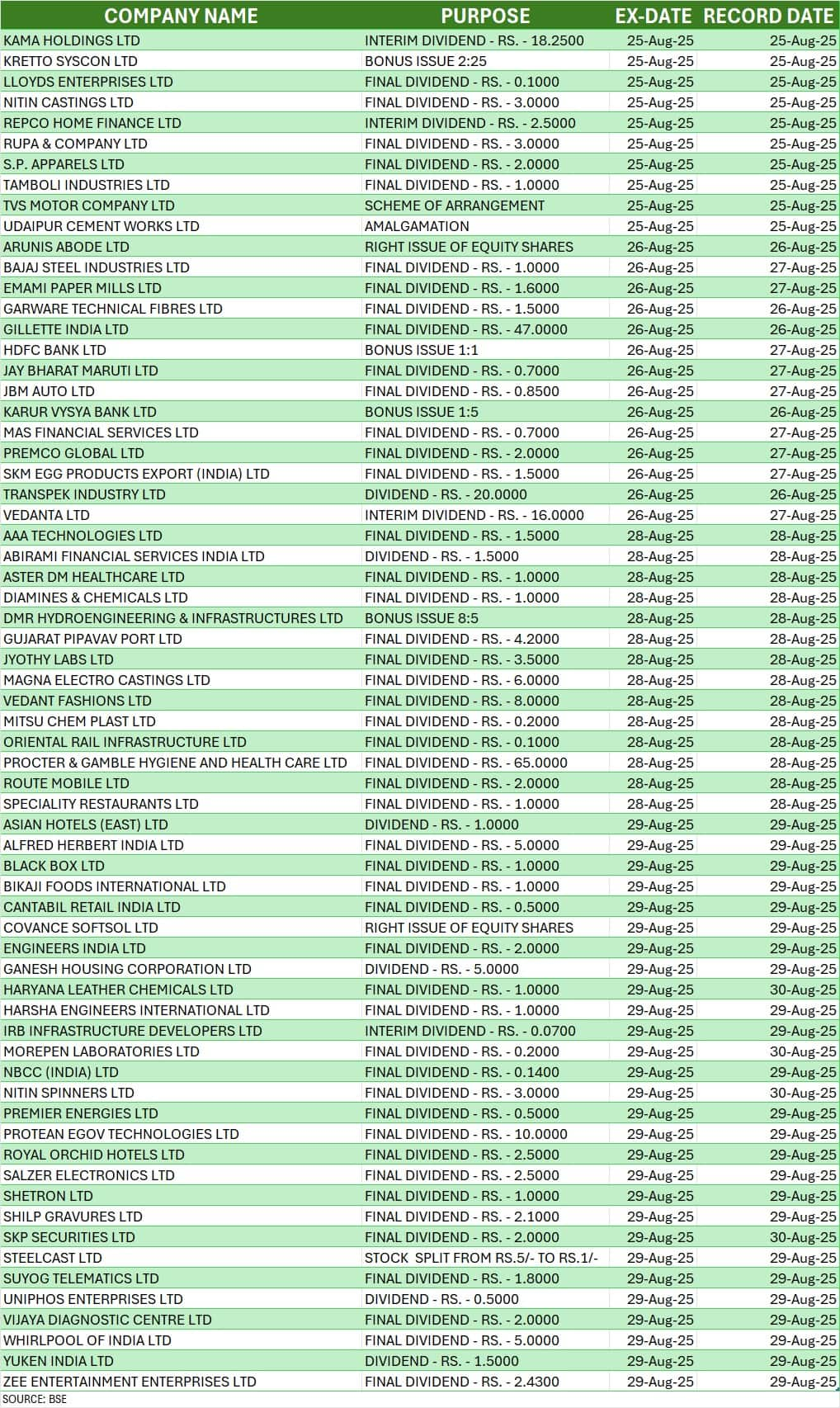

Next week, many companies will show corporate action like dividend, stock split and bonus issue. (See chart)

Also read: HAL will make fighter jet engine, LCA MK2 will be used in MK2; Technology will be available from American company

Disclaimer: Advice or idea experts/brokerage firms given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Moneycontrol advises to users that always seek the advice of certified experts before taking any investment decision.