July 07, 2025 , 9:22 am IST

Market Kulana: Sensex and Nifty 50 declines slightly in morning trade

The Sensex is at 83,365.44 points, 67.45 points dropped (-0.08%). The Nifty is at 50, 25,444.10 points, 16.90 points dropped (-0.07%).

July 07, 2025 , 9:22 am IST

Market Kulana: Sensex and Nifty 50 declines slightly in morning trade

The Sensex is at 83,365.44 points, 67.45 points dropped (-0.08%). The Nifty is at 50, 25,444.10 points, 16.90 points dropped (-0.07%).

Nifty technical view: The Indian stock market made a strong comeback on Friday after two days of weakness. The benchmark Nifty 50 index recovering rapidly from Intrade Low at the end of the session closing at around 25,461 of the day’s highest level. The Nifty declined by 0.69% on a weekly basis.

How will the mood of Nifty be on Monday, July 7, which levels will be important, will understand it from experts. But, before that, let us know what was special in the market on Friday and which factor will be eyeing the market on Monday.

Largecap stocks gained

Major shares like Bajaj Finance, Dr. Reddy’s and Infosys led the recovery and supported the Nifty. At the same time, selling pressure was seen in Trent, Tata Steel and Eicher Motors.

The Nifty Midcap and Smallcap index also declined at the beginning of the session, but both indices almost closed due to recovery in the second part of the day.

Sectoral trend and fund flow

All major index except the Nifty auto and metal on the sectoral front closed in the green mark. Oil and gas, realty, pharma and IT sectors saw the most shopping.

However, both domestic (DII) and foreign institutional investors (FII) were pure sellers in the cash market on Friday on the fund flow.

Market’s eye now on global events

Further investors will eye on two important global events on July 9- the minutes of the FOMC meeting of the US Trade Deadline and Federal Reserve. They may affect the global market perception.

Support and resistance level for Nifty

According to Nagraj Shetty of HDFC Securities, the Nifty has created a negative candle on the weekly chart. This indicates that the index is now on an important support zone, where the earlier resistance can now turn into support. He has described the next upside target 25,700 and 26,200 in two weeks, while 25,300 have been considered important support.

At the same time, the metaphor of LPK Securities also described 25,300 as important support. He says that as long as the index trades over it, it can remain fast. Target of 25,800–26,100 and resistance on 25,500 are being seen at the top.

Nandish Shah of HDFC Securities said that Nifty has made a bullish ‘hammer’ candle on the daily chart. This indicates that the recent correction may stop and the uptrend may resume. According to him, Friday’s low i.e. 25,331 will now serve as strong support. At the same time, the scope of 25,600–25,670 will be the nearest resistance zone.

Also read: Stocks to watch: 17 stocks will be in focus on the first day of business week, big movement can be seen

Disclaimer: Advice or idea experts/brokerage firms given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Moneycontrol advises to users that always seek the advice of certified experts before taking any investment decision.

Muharram 2025: Muharram is considered the second holiest month in Islamic traditions after Ramadan. According to the Islamic Hijri calendar, Muharram, a symbol of the beginning of the new year, has begun from June 27. This holy month is a symbol of sacrifice, unity, peace and harmony. This is the time to follow the ideals of Hazrat Imam Hussain, grandson of Prophet Muhammad. In Islam, Muharram is one of the four sacred months, meaning ‘prohibited’. During this period, war is forbidden and Muslims attach to more prayers.

On the 10th day of Muharram, Shia Muslims celebrate Shia Muslims as Mourning Day. They take out the procession and remember the sacrifices made by Hazrat Imam Hussain. On the other hand, Sunni Muslims fast on this day and offer Namaz.

Extra holiday will not be due to Muharram falling on Sunday

This year, the 10th day of Muharram, Ashura, was celebrated on 6 July. Since it occurred on Sunday, there will be no separate public holiday. Therefore, banks, government offices, post offices, schools and other public institutions will be open on 7 July. Since July 7 is not a public holiday, the stock markets on Muharram will also be open and will continue their business normally.

A total of 14 holidays of the stock market have been fixed this year. The last holiday of the market was on the occasion of Maharashtra Day on 1 May. The next holiday of the stock market will be on 15 August on the occasion of Independence Day. Apart from public holidays, the stock markets are all closed on Saturdays and Sundays.

Stock market holiday in 2025

26 February (Wednesday) – Mahashivaratri

March 14 (Friday) – Holi

31 March (Monday)-Eid-ul-Fitr (Ramadan Eid)

April 10 (Thursday) – Mr. Mahavir Jayanti

April 14 (Monday) – Dr. Babasaheb Ambedkar Jayanti

April 18 (Friday) – Good Friday

May 01 (Thursday) – Maharashtra Day

15 August (Friday) – Independence Day / Parsi New Year

August 27 (Wednesday) – Shri Ganesh Chaturthi

Overall, on July 7, 2025, NSE and BSE will be open and trading normally.

Market Outlook: The Indian stock market witnessed profits in the week ended July 4. The Nifty dropped 0.7% this week after a rise of about 4% in the last two weeks, although the low voliticity index (VIX) supported the market.

According to Siddharth Khemka, Wealth Management Research Head of Motilal Oswal Financial Services, the market is currently in a consolidation phase and is waiting for clarity on the US trade policy. At the same time, research head Vinod Nair in Geojit Investments says, “If the US-India trade deal has a positive result, it will benefit from business-sensitive sectors like IT, Pharma and Auto, especially.”

Let’s know about those 10 major factor, which will decide the condition and direction of the market in a businessman starting on Monday, July 7.

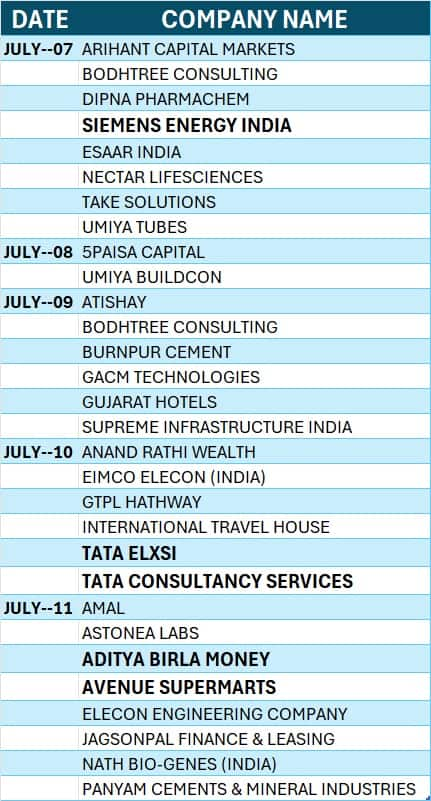

Quarterly results of companies

The market will be eyeing the corporate earnings season (April-June quarter 2025) starting next week. It will begin with the results of companies like TCS, Avenue Supermarts, Tata Alexi, Cemen Energy India and Aditya Birla Money.

Experts have high expectations from the quarterly results this time. He feels that the financial figures and management comments of companies may indicate strong recovery this year and can be revised upwards for a full year’s earnings. This is currently 12–13 percent. There are some important reasons behind this expectation- major changes in tax structure in the budget, cuts in interest rates from RBI, softening of geopolitical stresses and increasing capes of the government.

Trump tariff will be monitored

The most important factor on Global Front will be related to US President Donald Trump’s tariff policy. On July 9, the 90-day deferment is coming to an end in April to postpone the decision to impose recipes on all business partners. It will now be seen what amendment of the US tariff rates, how baseline rates are fixed and with which countries trade deals are finalized.

According to the latest reports, President Trump has warned that if there was no deal with Japan till 9 July, he could impose 30 or 35 percent tariffs. There have been agreements with Britain, China and Vietnam, while the possibility of a deal with India is considered strong. The European Union may also soon announce a basic agreement to postpone the new tariffs.

According to Kayanat Chanwala of Kotak Securities, the market may remain vigilant as Trump can issue tariff notices on 12 countries on July 7, Monday, some fees can go up to 70 percent. It is expected that all these tariffs will be effective from August 1.

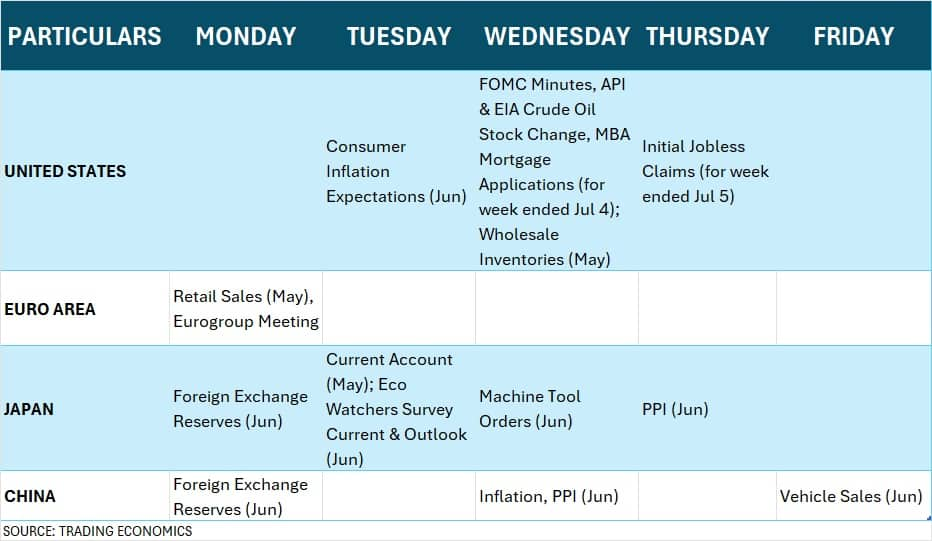

FOMC Minutes Tiki Eyes

The next week the market will also keep an eye on the minutes of the meeting held by the US Federal Reserve in June. The statements of that meeting and after this were said in the statements of several Fed officials that vigilance will be taken over the cuts cuts, as the increase in tariffs has caused the risk of inflation. Also, strong employment figures in the US indicate that the Fed does not have immediate need to reduce the interest rate.

However, some analysts believe that the possibility of cutting rates in July or September due to pressure from US President Donald Trump still remains. The Federal Funds Rate was kept stable at 4.25–4.50% for the fourth consecutive time in the June policy of the Fed.

Global economic figures

Apart from FOMC minutes, the US weekly job data and consumer inflation expectations for June will also be important for the market. Similarly, Europe’s retail sales data, Japan’s producer Price Index (PPI), China’s CPI and PPI figures will also come. All these figures can affect global market perception.

Crude oil prices are monitored

Crude oil prices are an important indicator for net importer countries like India. After the meeting of OPEC+ last week, prices saw fluctuations. Also, there is a possibility of further pressure on prices due to Trump’s new tariff policy.

According to Kayanat Chanwala of Kotak Securities, ‘OPEC+ has agreed to increase the production of 5,48,000 barrels per day (BPD) more than expected for August, which is much higher than the average of the last three months. This may put pressure on oil prices.

Meanwhile, the International Benchmark Brent crude recorded a 3% rise and closed at $ 68.8 per barrel over the weekend. However, last week it fell by more than 13%. Strong economic figures in the US and China supported prices, but the possibility of American tariff limited the boom.

FII flow will be monitored

In the domestic market, investors will be eyeing the mood of foreign institutional investors (FII) next week. Last week (30 June to 4 July) FII sold a total of ₹ 6,605 crore in the cash segment. Prior to this he was a consistent buyer. Selling was seen due to high valuation. However, domestic institutional investors (DII) compensated this weakness with a net purchase of ₹ 7,609 crore. Since August 2023, DII has been doing strong purchases continuously.

Vijaykumar, the Chief Investment Strategist of Geojit Investments, said, “FII shopping will depend on two things, if there is an Indo-US trade deal, it will be positive for the market and FII flow. Second, everyone will be eyeing how the results of Q1Fy26 live. “

The US dollar index fell for the second consecutive week and closed at 96.985 with a weakness of 0.28%, the lowest level after February 2022. However, it has been 0.21% above July in July. It fell by 12.15% during January-June.

Tremendous stir in IPO market

Next week, the speed of the primary market on Dalal Street will remain fast, where six new initial public offers (IPOs) are going to be launched. In the mainboard segment, a public issue of Travel Food Services will open a public issue of ₹ 2,000 crore on July 7, followed by the IPO of Smartworks Courting Spaces will start from 10 July.

Investors will also get many options in the SME segment. On July 7, Smarten Power Systems and Chemkart India will enter the market with an issue of ₹ 50 crore and ₹ 80 crore respectively. After this, on July 8, Glen Industries will bring an IPO of ₹ 63 crore, while on July 9, Asston Pharmaceuticals will launch a public issue of ₹ 27.6 crore. On the same day, CFF Fluid Control will also open a follow-on public offering of ₹ 87.8 crore.

Talking about the listing, IPO of Cryogenic OGS and Happy Square Outsourcing Services will be closed on 7 July and their listing will be on 10 July. Meta Infotech’s public offer will be closed on July 8 and its stock will debut on 11 July. Apart from this, on July 7, a total of five companies- Marc Loire Fashions, Vandan Foods, Pushpa Jewellers, Cedaar Textile and Silky Overseas will be listed in the market. Crizac is the only company in the mainboard segment to enter the stock market on 9 July.

Technical attitude

Last week, the Nifty 50 index continued to trade within a radius of 25,300 to 25,700, which is almost equal to the last week’s range. This shows that there is still a lack of clear direction and uncertainty in the market. According to the expert, if the Nifty breaks the level of 25,300 in the coming week decisively, the next support is considered at 25,200. If this level also breaks, the index can go down to a radius of 25,000–24,800.

At the same time, if the Nifty rests above 25,600–25,700, then the levels of 25,800–26,000 can open. The MACD is still built above the zero line and has a top of it. At the same time, Stokastic RSI has maintained a positive crossover on the weekly chart. The RSI is built at 62.4 above 60, although it saw a slight softness last week.

Weekly options data indicates that the broad scope for Nifty may be between 25,000 and 26,000, while the scope of 25,200–25,700 will be immediately able to monitor. Talking about call options, the most open interest is on 26,000 strikes, followed by 25,500 and 25,700. The highest call writing is at 26,000, followed by 26,200 and 25,700.

The most open interest in put options is on 25,000 strikes, followed by 25,200 and 25,400. The highest put writing is at 25,200, then at 25,300 and 25,400.

Meanwhile, India VIX has fallen for the third consecutive week and remains under all major moving averages, which is a relief for bulls. It fell 0.59% to close at 12.32 at the end of the week, which is the lowest level since September 2024.

Corporate action

Next week, many companies will have important corporate action. These include dividend, bonus issue and stock split. (See chart)

Also read: SIP Calculator: Investment of ₹ 5000 every month; How much money will be in the pocket after 5, 10 and 15 years?

Disclaimer: Advice or idea experts/brokerage firms given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Moneycontrol advises to users that always seek the advice of certified experts before taking any investment decision.

Transformer maker Voltamp transformers ltd Its shareholders are going to give a final dividend of Rs 100 per share for FY 2024-25. It was announced in the month of May. The record date for dividend is July 22. By this date, shareholders whose names will be in the records of the Register of Members of the Company or Depositors as the beneficiaries owners of shares will be entitled to dividend.

Voltamp transformers Ltd, transformers designing, manufacturing and supply business. It is a company of Vadodara, Gujarat. The company gave a final dividend of Rs 90 per share for FY 2024. The face value of the stock is Rs 10. The stock closed at Rs 9354.95 on BSE on Friday, July 4. The company’s market cap is Rs 9400 crore.

Shares strong 38 percent in 3 months

According to BSE data, Voltamp transformers ltd The stock has climbed 136 percent in 2 years and 38 percent in 3 months. It is about 28 percent of it in a year. The company had a 38 percent stake in the company till the end of March 2025. The share of 52 weeks of the stock is Rs 14,800 on the BSE, which was created on 28 August 2024. The 52 -week low of Rs 5,900 was seen on 7 April 2025.

In May 2025, MK Global Financial Services was given a target price of Rs 11350 per share with a ‘bye’ rating. Prabhudas Liladhar set a target of Rs 10285 with ‘bye’ rating.

How much profit in March quarter

In the January-March 2025 quarter, Voltamp transformers stood at the standalone basis of Rs 624.81 crore. The net profit was recorded at Rs 96.83 crore and Earnings per share was Rs 95.70 crore. During the financial year 2024-25, the revenue was Rs 1,934.23 crore, net profit was Rs 325.41 crore and Earnings per share was Rs 321.65 crore. The company’s annual general meeting is going to be held on 29 July.

Bonus Share: 8 new shares will be found free on every stock, stock will break in two pieces; 9300% return given in 5 years

Disclaimer: Here information provided is being given only for information. It is necessary to mention here that the investment market in the market is subject to risks. Always consult experts before investing money as an investor. There is never advice to anyone to invest money on behalf of Moneycontrol.

Market this week: On a week -long basis, the market lost the lead 2 weeks in the week ended on July 04. There was pressure in the market due to a big weekly decline in the financial sector. At the same time, investors remain alert in the market before tariff deadline. The Sensex closed 626.01 points, or 0.74 per cent, at 83,432.89 in the week ended July 04. At the same time, 176.8 points, or 0.68 percent, closed at 25,461 levels.

BSE’s smallcap index grew by 1 percent. Gabriel India, Sindhu Trade Links, PC Jeweller, SML ISUZU, NACL Industries, Heranba Industries, Prime Focus, SignPost India saw 20-42 percent rise. On the other hand, Sadhana Nitrochem, Sigachi Industries, Dreamfolks Services, Nuvama Wealth Management, Sammaan Capital, Jindal Worldwide, Narayana Hrudayalaya saw 11-22 percent decline.

Last week, BSE’s midcap index saw a growth of 0.6 percent. Laurus Labs, Relaxo Footwears, IDFC First Bank, Kalyan Jewelers India, Biocon, Glenmark Pharma, IPCA Laboratories, Ajanta Pharma, Ajanta Pharma, Endurance Technologies, GMRPORTS Aurobindo Pharma, Balkrishna Industries should be a gainer of midcap. On the other hand, Coromandel International, Brainbees Solutions, Godrej Industries, Go Digit General Insurance, FSN E-Commerce Ventures (NYKAA) should be loser of midcap.

BSE’s Lajcap Index saw a decline of 0.6 per cent. Trent, SBI Cards & Payment Services, Cholamandalam Investment and Finance Company, Hyundai Motor India, Swiggy, United Spirits saw a decline. While Bosch, Mankind Pharma, Punjab National Bank, Indian Overseas Bank, Bharat Petroleum Corporation, Divis Laboratories, Siemens saw an edge.

Last week, Trent’s market cap saw the biggest decline. After that HDFC Bank, Kotak Mahindra Bank, Axis Bank was number. On the other hand, the marketcap of Reliance Industries, Infosys, Bharat Electronics saw the most edge.

Looking at the sectoral front, the realty index lost 2 percent last week. The Nifty Bank Index and the FMCG index closed down 0.7 per cent. At the same time, Pharma Index, PSU bank index closed with 2 per cent, and IT, media index with a gain of about 1 per cent.

In the week ended July 04, the FII broke the process of purchasing for 2 weeks and sold Rs 6,604.56 crore. While DII continued its purchases for the 11th consecutive week and he purchased Rs 7,609.42 crore.

Indian rupee also continued to increase for the second week. The domestic currency closed at 85.39 per dollar on 4 July with a slight gain of 85.49 per dollar on 27 June.