Market Outlook: In the week ended July 11, the Indian stock markets were under pressure to sell for the second consecutive week. The Nifty and Sensex declined by more than 1%. The main reason for this was global trade tension, the start of the weak results of the June quarter and the Indo-US trade deal was delayed.

Foreign investors continued selling, which weakened the sentiment in the market. However, frequent purchases of domestic institutional investors (DIS), good monsoon, decreasing interest rates and low inflation supported the market to some extent.

Siddharth Khemka, head of research in Motilal Oswal Financial Services, said that uncertainty related to trade deal can keep the market in consolidation mode. Investors will now monitor CPI and WPI inflation data, Q1 results and Indo-US trade deal.

At the same time, according to Vinod Nair, research head in Geojit Financial Services, investors will keep an eye closely on the margin guidance and sectorial trends, especially during the Q1Fy26 results. These factor can reinforce the sentiment in the market.

Let’s know about those 10 important factor, which will decide the direction and condition of the stock market in the coming week.

Quarterly results of companies

The flow of corporate results will be faster next week. Last week, some companies released quarterly results, but now more than 125 companies will present their earnings reports. These include many Nifty-50 legendary companies, whose total weightage on the index is more than 32%. These include Reliance Industries, HDFC Bank, ICICI Bank, Axis Bank, HCL Technologies, HDFC Life, Tech Mahindra, Geo Financial Services, Vipro JSW Steel.

Also, Ola Electric Mobility, Tata Technologies, Angel One, Polycab India, Tata Communications, Bandhan Bank, L&T Finance and India Cements will also present their results next week. New listed companies such as possible steel tubes, HDB financial services and Kalpataru will also declare the results of the June quarter.

Last week, the Tata Consultancy Services (TCS) started the earning season with a weak quarterly results, making the market mood a little cautious.

The market will look at the new tariff announcements of US President Donald Trump at the global level. Last week, he announced a fee on several trade partners, which has increased vigilance in the international business environment. The delay in the Indo-US trade deal has also created concern in the market. Many sources expected that a mini trade deal would be done before July 9, but it did not happen.

Last week, Trump announced that 30% new tariffs would be implemented on imported goods from Mexico and European Union from 1 August. The reason for the failure of the negotiations behind this was given. Trump has also warned that if the two countries retaliate, the tariff can be increased further. It is worth noting that the share of these two countries is close to one-third of the total imports of America.

Earlier, Trump announced a 35% tariff on imports from Canada and 50% on Brazil. Apart from this, he also indicated to increase the current 10% tariff to 15-20%, making investors and alert.

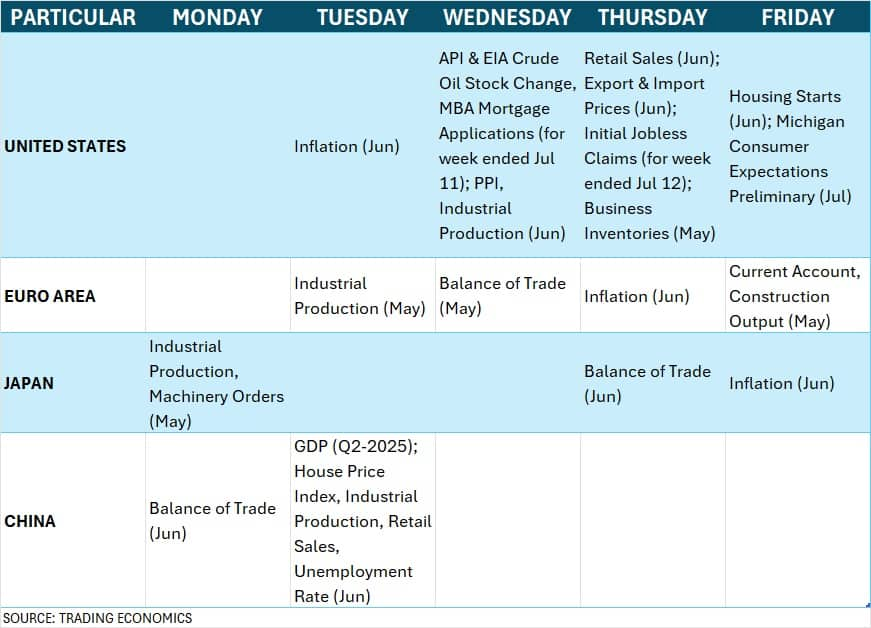

Next week, the market will eye on inflation data coming from America. In June, the US inflation rate may be slightly higher than the 2.4% of May. Trump has recently indicated that the tariff -based inflation in the US could increase the tariffs on several major trading partners and the last meeting of the Federal Open Market Committee (FOMC).

Apart from this, investors will also keep an eye on producer Price Index (PPI), retail sales and weekly job data from the US.

Apart from business-related activities and US inflation, China’s April-June quarter will also be monitored on GDP, retail sales and unemployment rates. Experts believe that this time China’s GDP rate may be slightly lower than 5.4% of the previous quarter.

Along with this, Japan and Euro zone will also reveal inflation figures of June, which can affect the market notion on global economic trends.

Domestic economic figures

The Indian markets will be eyeing the figures of retail and wholesale inflation (WPI) for the month of June, which are to be declared on 14 July. Economists estimate that retail inflation may fall to around 2.5–2.7%, which was 2.82% in May. If this happens, it will be the eighth consecutive month when retail inflation has declined. However, there may be some increase in wholesale inflation for June, which was 0.39% in May.

Apart from these, on July 15, the trades of trade balance and passenger vehicles for the month of June will also be released. At the same time, data of bank loan and deposit growth (up to fortnight on July 4) and foreign exchange reserves (till the week end on July 11) will be released on July 18.

Next week too, the activities of foreign institutional investors (FIIS) will play an important role in determining the direction of the market. However, the market has been getting the support of strong purchases of domestic institutional investors (DIIs). In the second week of July, Fiis was a net seller and sold for ₹ 4,511 crore. High valuation in the market is believed to be the main reason for this, due to which Fiis are shifting towards cheap markets.

Meanwhile, the US dollar index overcrowded from a 40 -month low and climbed 0.91% to close at 97.87. This was a bounce in safe haven demand due to the uncertainty produced by the tariff announcement of Trump. In contrast, the Indian rupee closed down to 85.7750, declining against the US dollar and declining 0.38%.

The speed of the primary market may be slightly slow next week. During this time three new public issues will be opened, one of which is of the mainboard and the remaining two of the SME segment. The mainboard IPO of ₹ 3,395 crore of Anthem Biosciences will open for subscription from 14 to 16 July. At the same time, Spunweb Nonwoven’s IPO of ₹ 61 crore will open on 14 July in the SME segment. Monika Alcobev’s ₹ 165.6 crore sme IPO will open from July 16. Both the issues will be closed this week.

Apart from this, the ₹ 583 crore IPO of Smartworks Covorking Spaces will be closed on July 14. It has received 1.15 times subscription so far.

Talking about the listing front, the Travel Food Services will debut in the stock market on July 14. This will be followed by Smartworks COWORKING Spaces on 17 July. At the same time, the listing of Smarten Power Systems and Chemkart India in the SME segment will be on 14 July. Glen Industries will enter the market on 15 July and Assston Pharmaceuticals on 16 July.

Technically, the market looks weak, as the Nifty 50 has broken the midline of 10 and 20-day moving averages (EMA) as well as the midline of the Bollinger Bands. Apart from this, weakness is also being seen in Momentum Indicators. Therefore, experts believe that as long as the Nifty remains below 25,300, the round of consolidation can continue next week.

Now the sight will be on the zone of 24,900–24,800, which is a low of 10-week EMA and the previous big bullish candle. If this level breaks, the selling in the market may intensify and the index can go up to 24,700. On the other hand, if the Nifty stays above 25,300, then a new fast may begin.

According to a weekly option data, the trend of Nifty 50 can be between 24,800 to 25,300 in the near future, while the broad scope is seen from 24,500 to 2500.

Call side: The most open interest was seen on a strike of 25,500, followed by 26,000 and 25,300. The highest call writing is at 25,300, followed by 25,200 and 26,000.

Put side: The most open interest was at 25,000, followed by 25,200 and 24,500. The highest put writing is at 25,000, followed by 24,800 and 25,200.

The index that describes the “fear” of the market of India Vix has fallen in the fourth consecutive week. It closed at 11.82, the lowest level since April 2024. Last week, it has fallen by 4.04%, indicating stability in the market and low volatility.

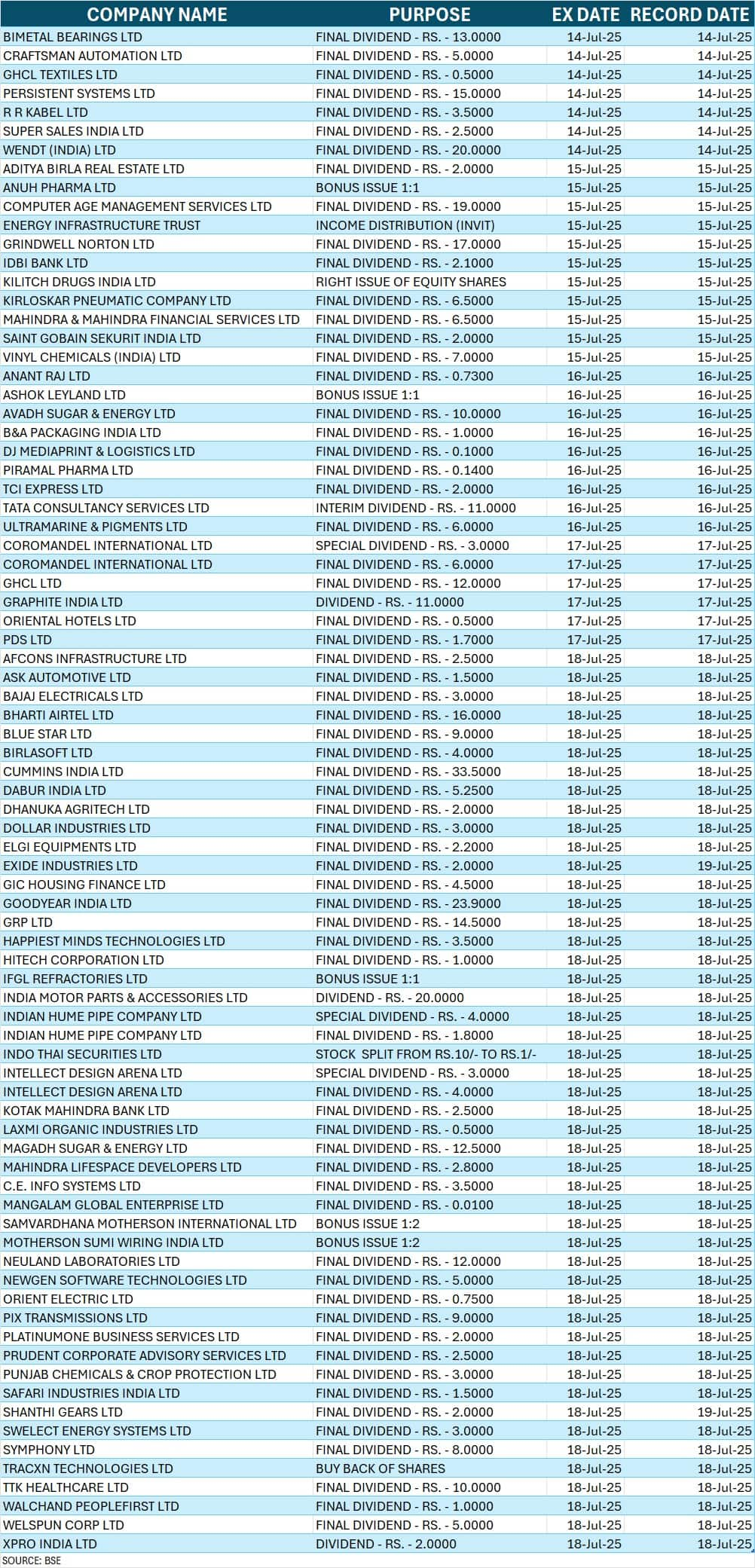

Many companies to be held next week will show corporate action. (See chart)

Also read: Nifty Trade Setup: How will the Nifty move on July 14, will Trump tariff be shocked?

Disclaimer: Advice or idea experts/brokerage firms given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Moneycontrol advises to users that always seek the advice of certified experts before taking any investment decision.