Market Outlook: In the week ended July 25, the bears also maintained control of the stock market for the fourth consecutive week. Especially midcap and smallcap shares remained pressure. The weak results of the June quarter, globally cautious stance and heavy selling of FII weakened the market notion.

Siddharth Khemka, Head of Wealth Management Research of Motilal Oswal Financial Services, believes that the market can remain in consolidation mode due to uncertainty about Indo-US trade deal, mixed results of Q1Fy26 and FII selling.

At the same time, Vinod Nair, the research head of Geojit Investments, said the average quarterly results can challenge the existing high valuation, which can put pressure on the benchmark index. Next week, American GDP and Jobs will be eyeing data, which can affect the decision -related decisions related to the Federal Reserve interest rates. Therefore, instability in the market cannot be ruled out.

Let us know about those 10 factor, which will decide whether the market will rise or decline in the week starting on Monday, 28 July.

The season of June quarter results will be at full speed next week, where more than 500 companies will present their quarterly results. These include major companies of NIFTY 50. Such as Larsen & Taubro, NTPC, Asian Paints, Indusind Bank, Tata Steel, Power Grid Corporation of India, Hindustan Unilever, Maruti Suzuki India, Mahindra & Mahindra, Mahindra, Coal India Sunia Sun Pharmaceutical Industries, ITC and Bharat Electronics.

In addition to Nifty 50, many big companies like PNB, Hyundai Motor India, Interglobe Aviation, TVS Motor Company, Swiggy, Adani Power, Tata Power, Mazagon Dock, NTPC Green Energy, NTPC Green Energy, Waaree Energie, Dabur Indians, Emami, Mankind Pharma will also present the results of the June quarter. Overall, the expert believes that the quarterly results so far have been mostly estimated.

Globally, everyone’s eye will now be on deals related to trade fee, as the increased deadline of the agreement with the US on August 1 is ending. US President Donald Trump has already warned that if there is no deal by the scheduled time, he will implement heavy tariffs on business partners. This time the focus is on the European Union, where the US is under plan to impose 30% import duty, if there is no agreement.

On Friday, Trump told the media that the possibility of agreement with EU is 50–50. Also, next week a new round of talks between the US and China will take place on Monday and Tuesday in Stockholm. According to media reports, both countries can consider extending the existing deadline (August 12).

In the case of India, the possibilities of mini trade deal with the US are currently fading. According to a senior government official, a team of US officials is coming to India in the second fortnight of August. The ban of 16% tariffs on India ends on August 1, so Trump’s decision will be important as to which countries will be implemented in case of lack of deal.

However, Union Commerce and Industry Minister Piyush Goyal said on Saturday that free trade agreement with European Union, America, Peru and Chile is progressing rapidly. Recently, the US has signed a trade deal with the United Kingdom, Japan, the Philippines and Indonesia.

Now investors will be eyeing the decision to be taken on the interest rates of the US Federal Reserve, which is coming on 30 July. Most economists believe that the Fed may keep their policy interest rates stable for the fifth time at 4.25–4.50%, as the authorities want to see the effect of the first tariff. However, Fed Chairman Geom Powell is under pressure to cut interest rates from the Trump administration. The market will now find an indication whether the September policy is likely to be cut.

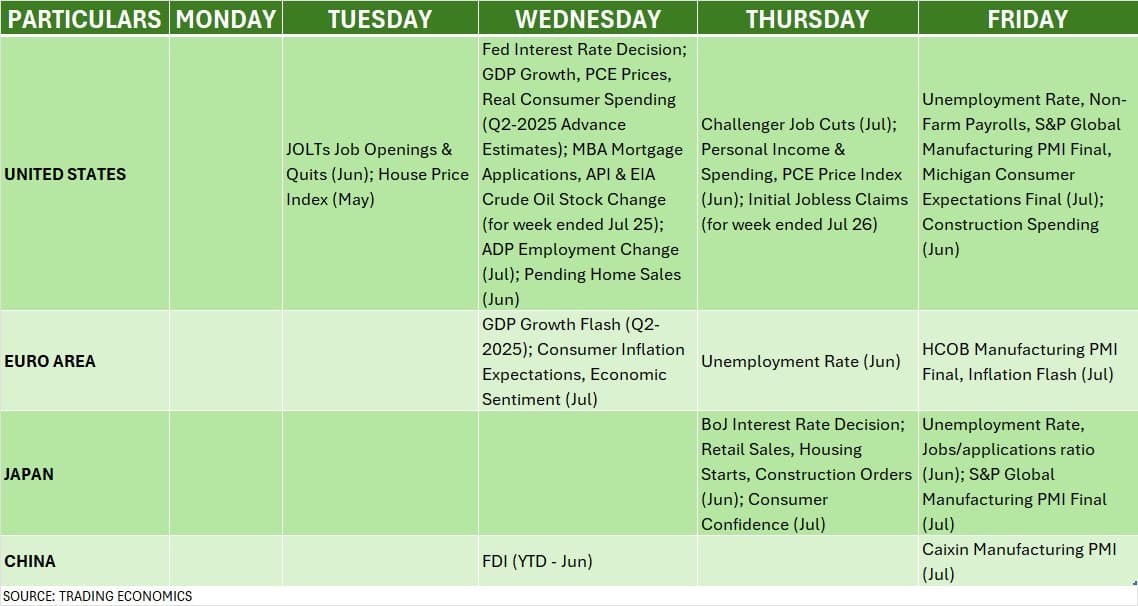

In addition to the Fed meeting, the next week will be data-wave for America. This includes the April-June quarter GDP advance figure, PCE price, real consumer spending, monthly unemployment rate, non-form on rolls, jolts job data, personal income and expenses figures, and pending home cells reports. Most economists believe that unemployment rate may increase in July, which was 4.1% in June.

Apart from this, GDP growth flash data of Q2-2025 from Europe and meeting at the interest rates of Japanese Central Bank (BOJ) will also be in focus. Also, manufacturing PMI data of many countries will also be released next week.

On the domestic front, the market will be eyeing the auto sales volume data of the month of July, which will be released in the end of the next week. Therefore, auto companies like Tata Motors, Maruti Suzuki, TVS Motor, Eicher Motors, Hero Motocorp, Bajaj Auto, Escorts, Ashok Leyland and Hyundai Motor India will be in focus. The performance of these companies was mixed in the month of June.

The Industrial Production (IIP) and fiscal deficit for the month of June will be released on 28 and 31 July respectively, which will be sight of the market. HSBC Manufacturing PMI data will also be released on 1 August, with flash data, the manufacturing activity has increased from 58.4 of June to 59.2 in July.

On the same day, data of bank loan and deposit growth (for fortnight ended July 18), and Foreign Exchange Reserve (for the week ended July 25) will also be released.

The market will also be eyeing the activities of FII (Foreign Institutional Investors). Last week, FII sold shares of ₹ 13,553 crore, causing a total net outflow of July to ₹ 30,509 crore. It was a large selling after four consecutive months net purchases. However, FII continued strong purchases in the primary market. After the June quarter results, the possibility of income cuts and high valuation can be the main causes of this selling.

At the same time, domestic institutional investors (DIIs) made up for FII selling. He bought shares of ₹ 17,932 crore last week and about ₹ 40,000 crore in the month of July.

Meanwhile, the US dollar index which remained under pressure last week after the last two weeks, closed 0.8% to close at 97.67. Next week it may have volatility as the American tariff deal deadline and fed meeting is coming near. The Indian rupee weakened the fourth consecutive week and fell 0.39% to close at 86.4570 against the dollar.

The Ahway is going to be very busy for the primary market, as a total of 14 public issues will be worth more than ₹ 7,300 crore and the listing of 12 companies is fixed in the market.

Talking about the mainboard segment, Laxmi India Finance, Aditya Infotech, National Securities Depository (NSDL), Sri Lotus Developers & Realty, and M&B Engineering will launch your IPO.

Investors will get to see 9 public issues in the SME segment- Umiya Mobile, Repono, Kaytex Fabrics, Takyon Networks, Mehul Colors, BD Industries Pune, Renol Polychem, Cash Ur Drive Marketing, and FlysBs.

Apart from these, IPOs of companies like Brigade Hotel Ventures, Shanti Gold International, Patel Chem Specialities, Shree Refrigractions and Sellowrap Industries were opened last week. These will be open for a few days of the next week.

The listing of a total of 12 companies is also fixed next week. These include – Indqube spaces, GNGE Electronics, Brigade Hotel Ventures, Shanti Gold International, Propshare Titania, SAVY Infra & Logistics, Logistics, Swastika Castal, Monarch Surveyors & Engineering Constant TSC India, Patel Chem Specialities, Shree Refrigerations and Sellowrap Industries.

Technical view and F&O condition

Technically, there is a possibility of more consolidation in Nifty 50, in which there may be a trend of weakness. Because Momentum indicators are getting weaker. The index has created a hint of recession for four consecutive weeks and broke the lower level of the long green candle of the week ended on June 27.

24,700 will serve as an important support in the coming week, followed by 24,550 (20-week experienced average) a critical support. Selling can be faster when it goes under it. At the top 25,000 will remain a significant resistance, and then 25,250 which was the highest level of the previous week.

Since it is a week of monthly expiry of futures and options, market volatility may increase. According to options data, NIFTY can live in a radius of 24,700 to 25,200 in the near period, while the broader range will be between 24,500 to 2500.

Meanwhile, the volatility index i.e. the Fear Index has fallen to 11.28 consecutive week to 11.28, which is the lowest level after April 2024. While the market has brought stability in the market, it also indicates a large movement (up or down).

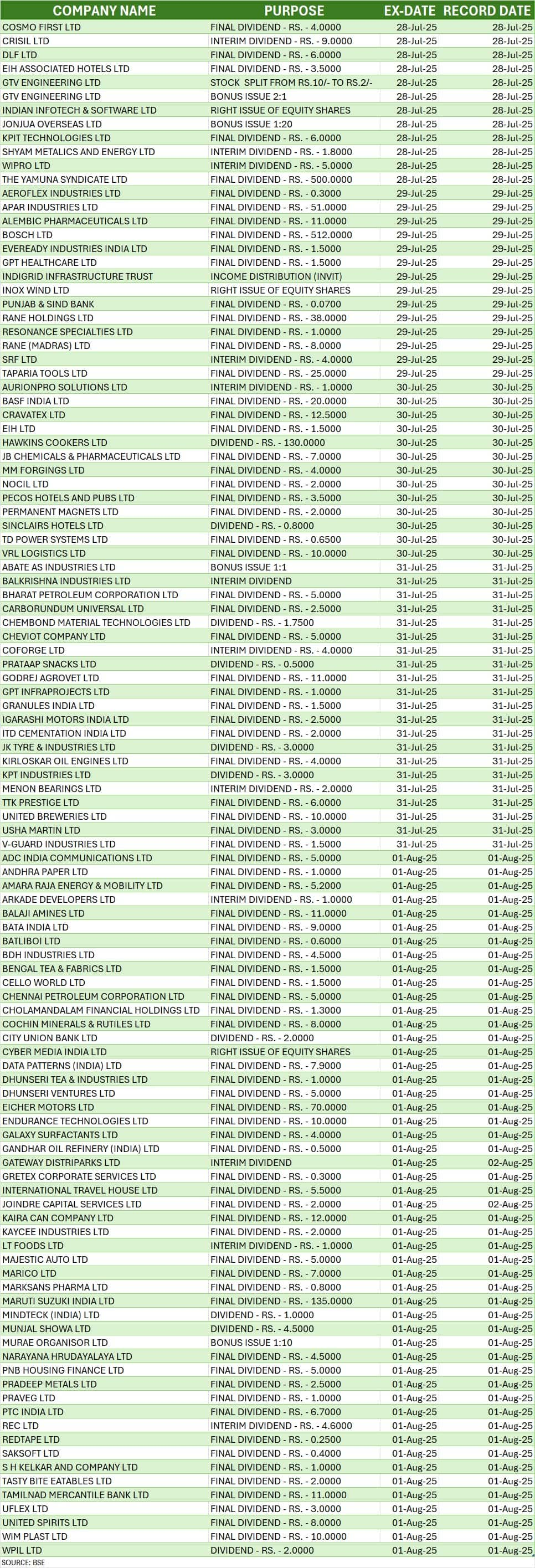

Next week, many companies are also going to show corporation action like dividend and bonus shares. (See chart)

ALSO READ: Stocks to Watch: These 16 stocks will be in focus on Monday, July 28, you can get a chance to earn strong earnings

Disclaimer: Advice or idea experts/brokerage firms given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Moneycontrol advises to users that always seek the advice of certified experts before taking any investment decision.