Market Outlook: The previous trading week closed in the stock market in red mark. This was the third consecutive week when the market showed weakness. NIFTY 50 psychologists fell below 25,000 points in the week ended July 18. This decline was seen due to a weak start of the June quarter results and uncertainty related to tariffs. On Monday, the market will first react to the results of Index Heavyweights like Reliance Industries, ICICI Bank and HDFC Bank, which were released after the Friday market was closed and on Saturday.

Siddharth Khemka, head of research and wealth management in Motilal Oswal Financial Services, believes that the market will currently remain in consolidation mode given uncertainty in global trade and the sluggish start of Q1Fy26 results.

At the same time, according to Vinod Nair, research head of Geojit Investments, if a positive solution is found from the proposed US-India Mini Trade Agreement, it can strengthen the outlook of export-based sectors. He also added that strong earning growth is necessary to justify India’s high valuation.

Let’s know about those 10 important factors, which will decide the direction and condition of the stock market in the business starting on Monday, 18 July.

June quarter results

The season of the June quarter results starting from July 21 will be at full speed. A total of 286 companies will declare their financial results during this period. These include 12 companies of Nifty 50- Infosys, Kotak Mahindra Bank, Bajaj Finance, Ultratech Cement, Eternal, Dr Reddys Laboratories, Tata Consumer Products, Nestle India, Sbi Life Company, Bajajaji Finserv, Cipla and Shriram Finance.

Apart from this, Bank of Baroda, Canara Bank, ACC, One 97 Communications (Paytm), Colgate Palmolive, Dixon Technologies, United Breweries, Zee Entertainment Enterprises, Bajaj Housing Finance Finance Finance Finana Balkrishna Industries, IDFC First Bank and Premier Energies will also result in results.

Effect of trump tariff

Globally, investors of different asset classes will be eyeing the next move of Donald Trump administration, as there is less than two weeks left in the August 1 deadline. It is believed that this will be the last deadline extension. After this, the tariff rate will be implemented on business partners.

Global experts believe that this tariff-based uncertainty may further avoid the US Federal Reserve. The possibility of cuts in the July policy meeting is quite low, while the possibility of cuts of 25 basis points in September has also come down to just 50%.

Federal chairman speech

The upcoming week will remain relatively calm in terms of data, but the market will be eyeing the speech of Fed Chair Zerome Powell on 22 July. This speech is considered to be important from the perspective of giving direction to the future of interest rates, especially before the FOMC meeting to be held in the last week of July.

So far most of the Federal Reserve officials have indicated that the remaining part of 2025 is possible to cut Fed Funds Rate. However, he has also described the uncertainty related to business and policy and his influence on inflation is also very important.

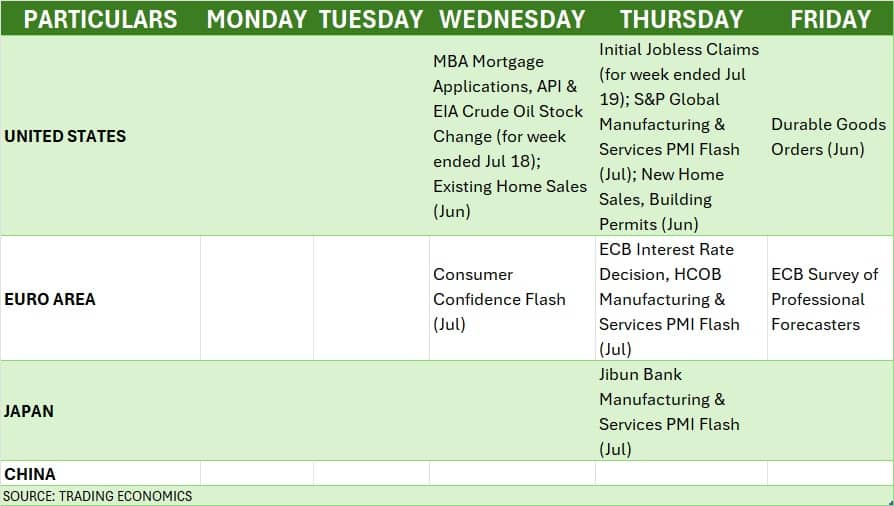

Global Economic Data

The decision on the interest rate of the European Central Bank (ECB) is going to be held on July 24, which will be sight of the market. Policy makers can probably keep interest rates stable at 2 percent and want to wait for the tariff decision of Trump, only then the rates can be likely to change.

Apart from ECB, the market will also be eyeing the flash figures of manufacturing and services PMI released by many countries. Along with this, investors will also be monitored on the US weekly jobs data.

Next week, the activities of foreign institutional investors (FIIS) will also be closely monitored. Last week, FIIS extracted ₹ 6,672 crore from the cash segment. Due to this, the total withdrawal has reached around ₹ 17,000 crore so far in July. The analyst believes that this withdrawal is happening due to high valuation, weak earnings and global tariff uncertainty, especially when there was a continuous net boying in the last three months.

In fact, FIIS has a continuous short position in index futures from June 30, which shows the spirit of recession in the market. Conversely, domestic institutional investors (DIIs) compensated the withdrawal of FIS. He has purchased ₹ 9,491 crore in the cash segment last week and ₹ 21,894 crore so far in the month of July.

Meanwhile, the US Dollar Index witnessed the second consecutive week of purchases and closed 0.61 percent to close at 98.46. It remained in the 20-day and 50-day EMA range.

Domestic Economic Data

The infrastructure output figures for the month of June on the domestic front will be released on July 21. After this, on July 24, the flash figures of the Manufacturing and Services PMI of July will be revealed. In May, these figures were 57.6 and 58.8 respectively, which increased to 58.4 and 60.4 in June.

In addition, data of foreign exchange reserves will be released on 25 July. In the week ended July 11, the reserves had come down to $ 696.670 billion, which was $ 699.740 billion last week.

IPO market condition

The movement in the primary market is going to be fast next week, as a total of 11 new IPOs are going to land on the Street. Of these, 6 will be from SME segment and 1 from Reit segment. The ₹ 473 crore IPO of Propshare Titania will open on July 21. This is the second scheme of property share investment trust Reit.

In the mainboard segment, INDIQOBE Spaces’ ₹ 700 crore IPO and laptop-decatop refurbishing company GNG Electronics will open the first issue of ₹ 460.4 crore on July 23. The ₹ 759.6 crore IPO of Hotel Chen Brigade Hotel Ventures will open on July 24. At the same time, the IPO of gold jewelery manufacturer Shanti Gold International will be launched on 25 July.

In the SME segment, IPOs of Savy Infra & Logistics and Swastika Castal will open on July 21. The public issue of Monarch Surveyors & Engineering Consultants will open from July 22, followed by TSC India’s ₹ 25.9 crore IPO on 23 July. IPOs of Patel Chem Specialities and Sellowrap Industries will open on July 25 for subscription.

On the listing front, the mainboard company Anthem Biosciences will debut on the stock exchange on 21 July. The listing of Spunweb Nonwoven and Monika Alcobev of the SME segment will be held on 21 and 23 July respectively.

Technical attitude

From the technical perspective, the market’s short-term trend is seen going in favor of trends, as the index is trading under 20-day EMA and reached 50-day EMA (24,900) last week. On Friday, the index broke the support trendline going upwards with a volume above average.

Momentum indicators are also weak and have fallen to RSI 43.07. According to experts, if the Nifty 50s break the level of 24,900 in a unique way, the index can go up to 24,800–24,500 zones. However, if this level is defended or the index surrounding it, then there may be a possibility of gradually recovery towards 24,200–24,300.

F&O segment condition

According to a weekly options data, the Nifty 50 is expected to remain within a wider scope of 24,500 to 25,500, while the near -term range can be between 24,800 and 25,300.

The highest open interest on the call option side was seen on a strike of 25,200, followed by 25,100 and 25,500. Call writing occurred mainly on 25,100 strikes, then a stir at 25,000 and 25,200 strikes.

Talking about the put option, the highest open interest was on 24,900 strikes, followed by 25,000 and 24,500 strikes. The highest put writing was also on 24,900 strikes, followed by activity at 24,950 and 25,000 stripes.

Meanwhile, India VIX means ‘Fear Index’ remained in a weak field and closed at 11.39 levels. This is the lowest closing level after April 2024. It remained in the fifth consecutive week decline, which shows stability and confidence in the market. It can also warns a possible breakout or breakdown.

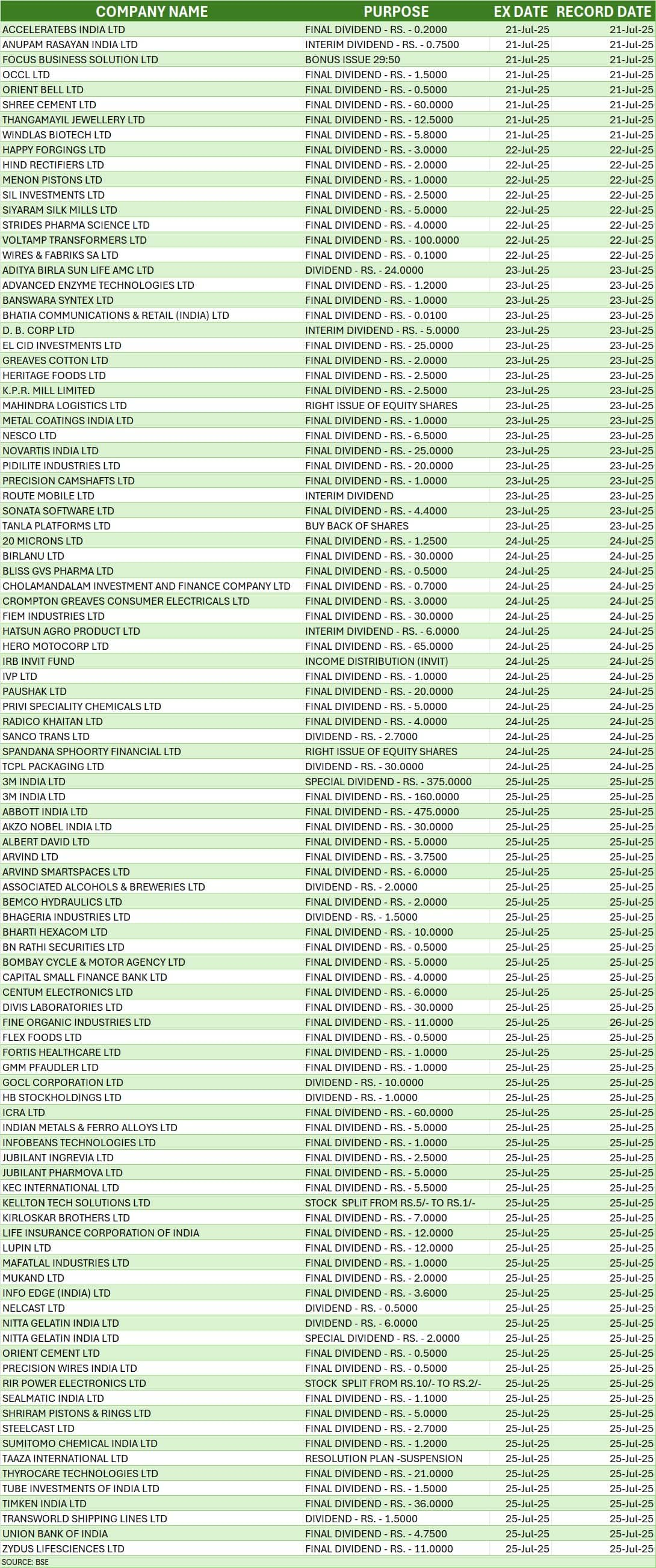

Corporate action

Many companies to be held next week are going to have corporate action like dividend and bonus issue. (See chart)

ALSO READ: Vedanta vs Viceroy Research: American short seller’s new war on Vedanta, told the semiconductor unit ‘Shell Trading Operation’

Disclaimer: Advice or idea experts/brokerage firms given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Moneycontrol advises to users that always seek the advice of certified experts before taking any investment decision.