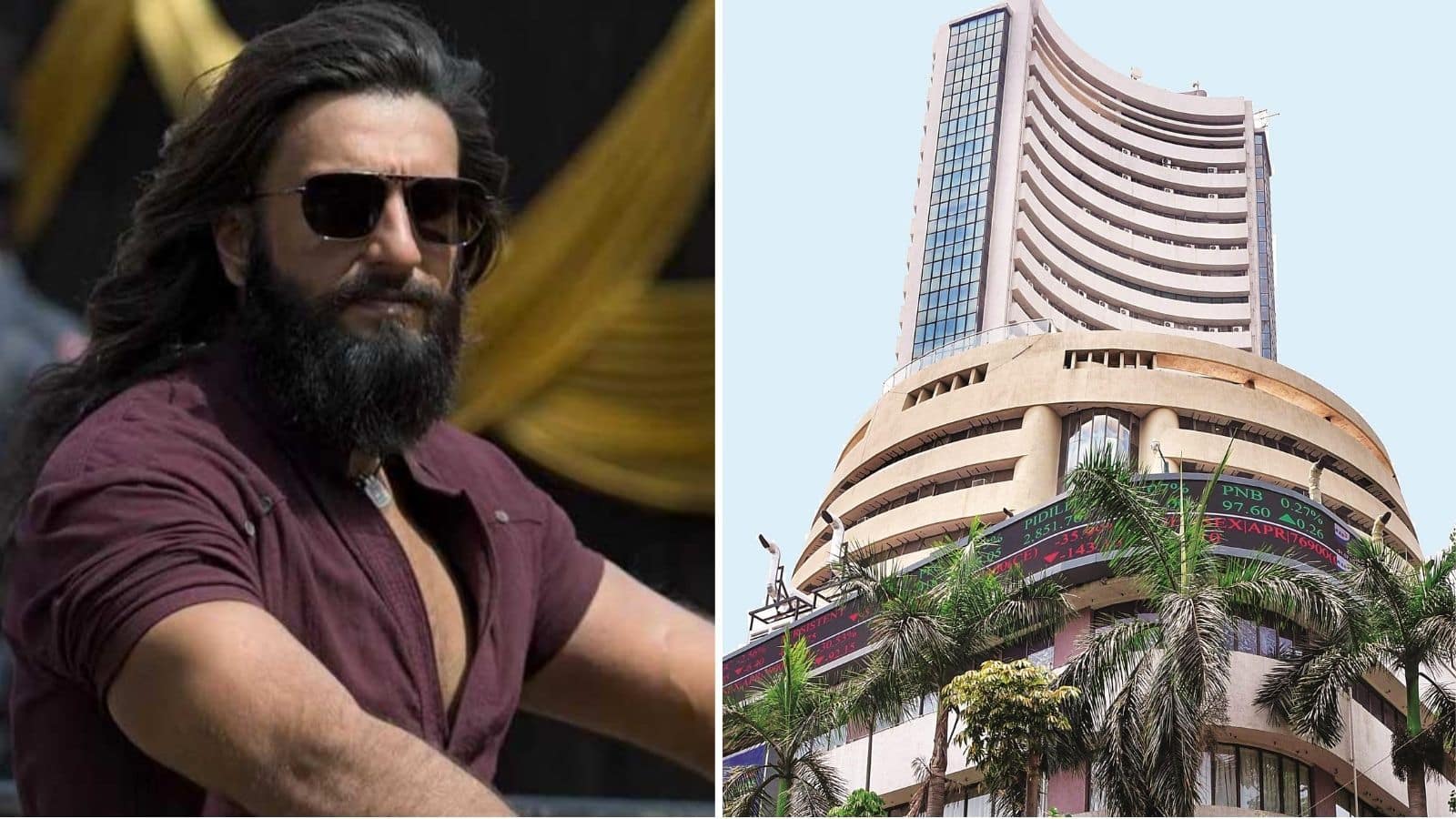

How to become a long-term investor in the share market? This can also be learned from Ranveer Singh’s recent blockbuster film ‘Dhurandhar’. In the film Dhurandhar, Ranveer Singh has played the character of a man named Hamza. The life lessons shown in the film through Hamza are very important for an investor also. Many aspects of Hamza’s life teach us the art of staying in the stock market for a long time. Let us know them.

1. ‘Eyes and Patience’

R Madhavan has played the role of IB Chief Ajay Sanyal in the film. In one scene, Ajay Sanyal gives an important mantra to his recruit Hamza before going into the dangerous world of Lyari, Karachi – “Nazar and Patience.” This dialogue may have been spoken in the context of an undercover spy, but this same principle is also the foundation of long-term investing.

No investor in the stock market can time the market correctly. In such a situation, keeping patience and doing Systematic Investment (SIP) is considered to be the best strategy. While there is a risk of huge fluctuations in short-term trading, patience pays off in the long run.

In the film, Hamza waits for the right opportunity to join the gang of Rehman dacoit (Akshay Khanna), that is, he maintains both vision and patience. Like Hamza, an ideal long-term investor also waits for the right opportunity in the market and does not indulge in the race for short-term profits. By ‘keeping an eye’ on the market, you may spot several corrections, where entry opportunities may arise.

Experienced investors say that instead of getting nervous about market fluctuations, it is more beneficial to increase investments wisely in a downturn. It is not necessary to check the portfolio every day, but making additional investments during downturns increases the chances of getting higher returns in the long run.

2. Luck changes at the right time

R Madhavan’s character in the film also explains to Hamza that, “Fate has a beautiful habit, that it changes when the time comes”. This line fits perfectly for long-term investors. Hamza also took this to heart and did not take any decision in haste because he firmly believed in this philosophy. Similarly, investors can also regain their confidence in a beaten stock by reading the annual report of the company. All weak stocks should not be ignored as many fall due to external reasons, but with the right timing they bounce back and reach new heights.

Similarly, investors investing in the index should also understand that the recession period in the index does not last very long and a ray of hope definitely emerges. As the old investor says, “Buy the right stock, sit back.”

3. It is also important to keep records and set goals

In the film, Hamza keeps an account of his every step and future plans. This habit is also considered very important from the investment point of view. Experts say that investors should review their portfolio at least once in six months. This not only makes the direction clear but also provides motivation for further goals.

The initial goal should be to invest in such a way that the capital remains safe. After this, the aim should be to beat inflation and fixed deposits. After this the power of compounding gradually shows its effect. However, it usually takes 5-6 years and is the toughest test of patience.

4. Hamza vs Rehman Dacoit: Two different paths of investment

Like every film has a villain. Similarly, in the film Dhurandhar, Rehman was the character of dacoit, which was played by Akshay Khanna. In the world of stock market, F&O (Futures and Options) plays the role of Rahman Dacoit. In the greed for quick profits, new investors often adopt shortcuts. For this they are drawn towards F&O. But SEBI figures show that 90% of investors investing in F&O suffer losses. On the contrary, regular and disciplined investments, albeit slowly, yield better results in the long run. When it comes to stock market, always be like Hamza, work hard and only then you will get the desired result in the end.

Also read- Meesho Shares: Meesho shares fell 21% in three days, these are the big reasons, experts are expressing concern

Disclaimer: The views and investment advice given by experts/brokerage firms on Moneycontrol are their own and not those of the website and its management. Moneycontrol advises users to consult certified experts before taking any investment decision.