Nifty trade setup for August 6: The benchmark Nifty saw a selling pressure on August 5 after a day’s rise. The market vigilance was seen before the results of the RBI policy meeting to be held on August 6. Its Nifty fell 73 points. The sequence of lower high, lower low formation is intact among the bearish Momentum Indirators. Along with this, the index continued to trade below both short and medium -term moving average. Therefore, if the Nifty decishes the level of 24,500 decisively, which corresponds to the lower level of the previous week as well as the lower level of June, the selling pressure may increase further. However, experts also say that it is very important to keep an eye on the level of 24,800-24,900 at the upper level. These levels can be accelerated when it is crossed.

Here you are giving some such figures on the basis of which you will be able to catch profitable deals.

Support and resistance level for nifty

Support on Pivot Point: 24,603, 24,569 and 24,515

Resistance based on Pivot Point: 24,712, 24,746 and 24,800

Bank nifty

Resistance based on pivot points: 55,574, 55,679 and 55,849

Support on Pivot Points: 55,234, 55,129 and 54,959

Resistance based on Fibonacci Retress: 55,075, 54,379

Fibonacci Retresh’s support: 55,766, 56,122

Amidst poor global atmosphere, Fiis sold in it, financial, oil and gas shares, know where shopping was done

Nifty call option data

A maximum call of 1.33 crore contracts has been seen open interest on a strike of 25,000 on the monthly basis, which will work as an important registration level in the upcoming business sessions.

Nifty put option data

On a strike of 24,000, a maximum number of 91.95 lakh contracts have been seen open interest which will work as important support level in the coming business sessions.

Bank Nifty Call Option Data

Bank Nifty has seen a maximum call open interest of 21.59 lakh contracts on a strike of 57,000, which will work as important registration level in the coming business sessions.

Bank Nifty put option data

The bank Nifty has seen a maximum put open interest of 13.89 lakh contracts on a strike of 57,000, which will work as an important registration level in the upcoming business sessions.

FII and DII Fund Flow

India Vix, which is considered a measure of fear, was also softened yesterday and it fell 2.13 percent to 11.71, which gave some relief to Tejdis. Overall, the VIX being at the lower level gives stability to the market and indicates the possibility of trading in a limited scope. However, the possibility of suddenly rapid fluctuations on both sides can not be ruled out.

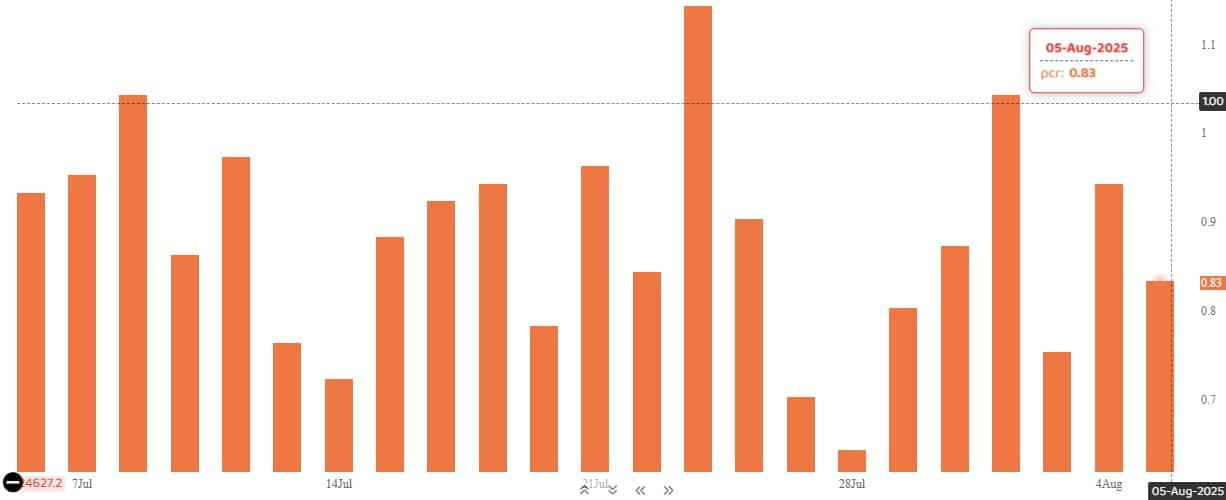

Call call ratio

The Nifty Put-Call Ratio, which depicted the market mood, fell at 0.93 on August 5, while it was at 0.94 levels in the previous session. Significantly, the departure of PCR above 0.7 or 1 cross PCR is generally considered a sign of boom. Whereas the ratio falling below 0.7 or 0.5 is a sign of recession.

Stock under F&O Bain

The F&O segment includes the restricted securities that include the derivative contract market wide position limit to more than 95 per cent.

Stock involved in F&O ban: no one

Stocks already involved in F&O ban: PNB Housing Finance

Stock removed from F&O ban: no one

Disclaimer: The ideas given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Money control advises users to seek the advice of certified experts before taking any investment decision.